Bank of Canada Holds Interest Rates Steady at 5%

Latest Decision Leaves Economists and Markets Unmoved

Next Decision Expected to be Hold in February 2023

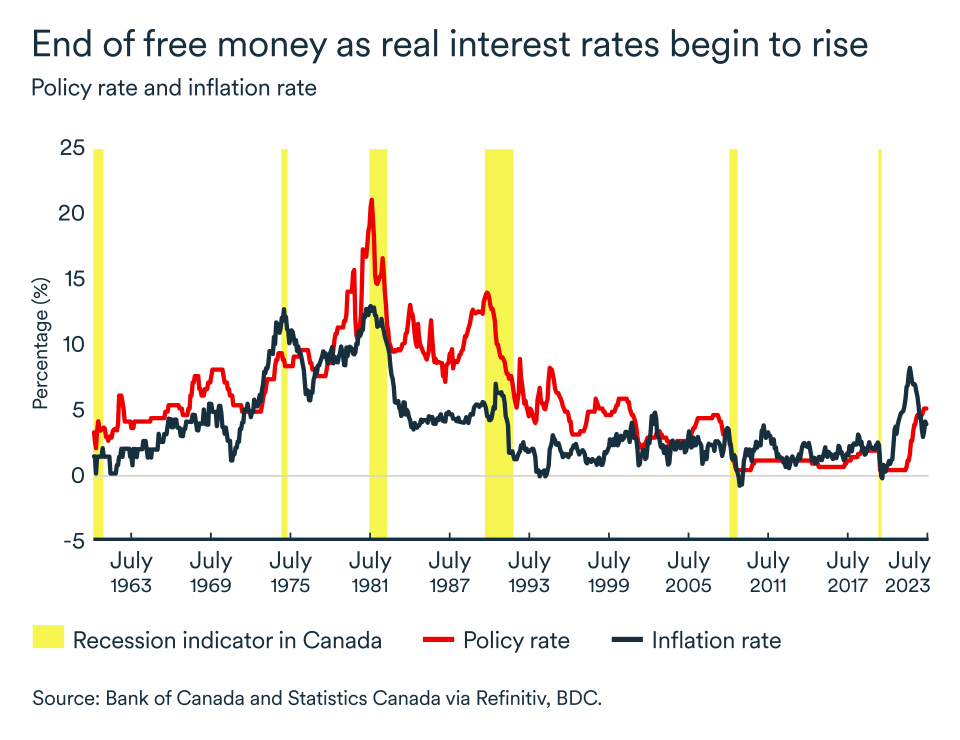

The Bank of Canada (BoC) announced today, December 6, 2023, that it has decided to maintain its target for the overnight rate at 5%. This marks the third consecutive hold by the central bank, leaving economists and markets largely unmoved.

The decision was widely anticipated, as most analysts had predicted that the BoC would keep rates on hold at its final meeting of the year. The central bank has been raising rates aggressively since March in an effort to combat high inflation. The latest data for CORRA Canada's risk-free rate can be viewed or downloaded here. The Bank of Canada's next interest rate decision is scheduled for February 1, 2023.

However, one expert warns that the Governor of the BoC, Tiff Macklem, may be signaling a more hawkish stance in the future. In a recent speech, Macklem said that the BoC is "prepared to act more forcefully" if necessary to bring inflation down to its target of 2%.

The BoC's decision today is a sign that the central bank is taking a cautious approach to raising rates. The economy is slowing down, and the BoC is likely worried about raising rates too quickly and causing a recession. However, the BoC has also said that it is committed to bringing inflation down, and it is likely to continue raising rates if necessary.

The BoC's next interest rate decision will be closely watched by economists and markets alike. The decision will provide further insight into the central bank's thinking about the economy and inflation, and it will help to shape expectations for future rate hikes.

View or download the latest data for CORRA Canada's risk-free rate here.

Read the central bank's official statement here.

Comments