Bank of Canada Holds Interest Rate Steady, Cuts on Horizon

Inflation Eases, Raising Hopes for Imminent Rate Cut

Central Bank Signals Potential for Further Rate Hikes

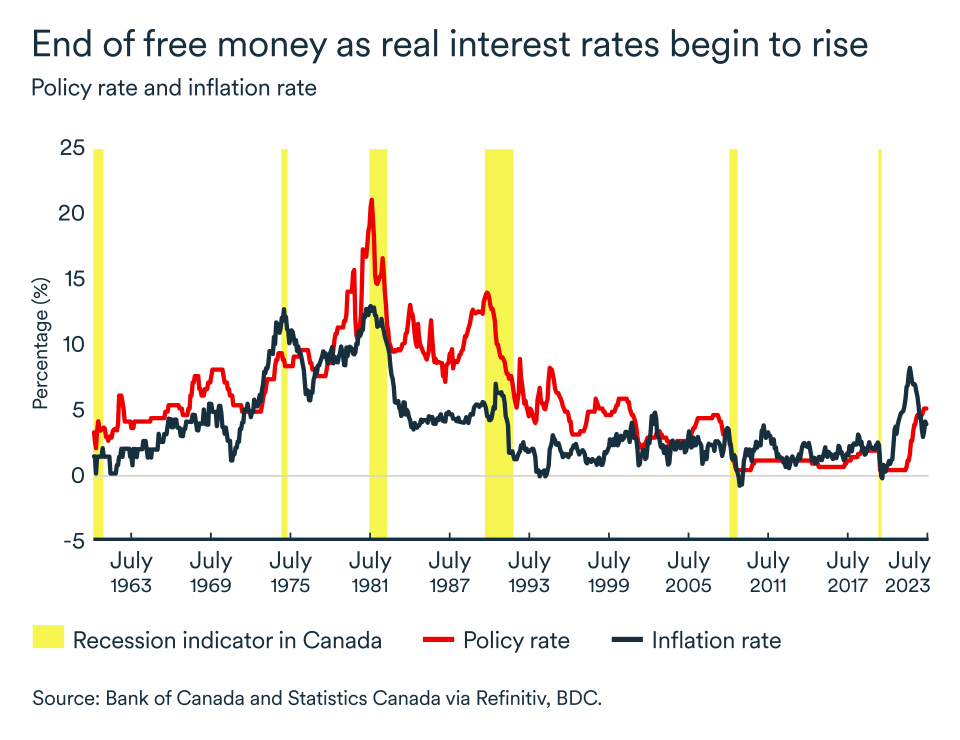

The Bank of Canada (BoC) left its benchmark interest rate unchanged at 5% on Wednesday, a move that comes amid signs of cooling inflation and signals that a rate cut in June is a possibility.

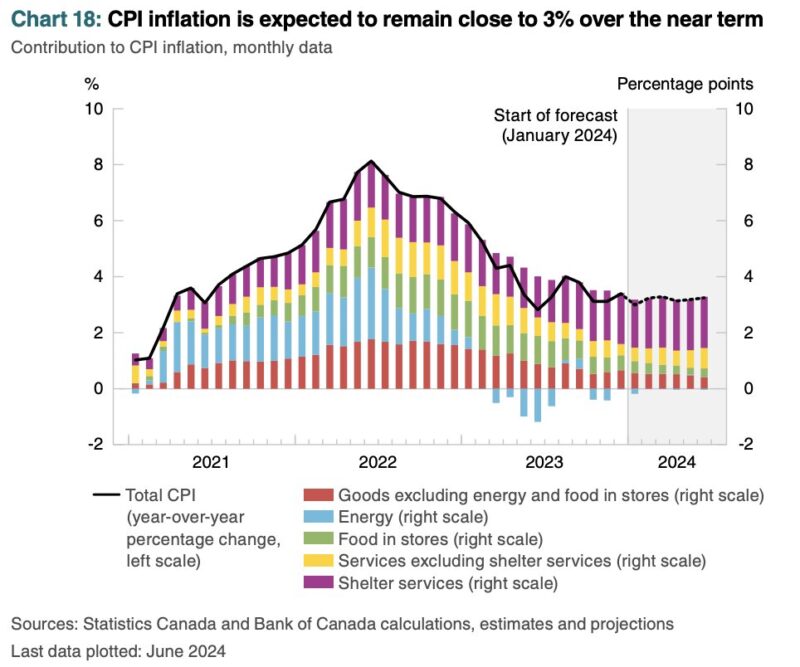

Canada's annual inflation rate decelerated to 2.8% in February, beating economist expectations and fueling optimism that the BoC will soon ease its monetary tightening stance.

The BoC maintained its cautious stance, acknowledging that further rate hikes may be necessary if inflation persists. However, the central bank's dovish tone suggests a willingness to pause its tightening cycle and potentially consider rate cuts in the near future.

The BoC's current interest rate stands at 5%, below the Federal Reserve's target range of 5.25% to 5.50%. This divergence in monetary policy approaches underscores the challenges facing central banks as they navigate the global economic landscape.

Comments